In the Keiretsu Forum Northwest & Rockies March 2022 Roadshow, we invited thought leaders from the angel investment world to share their expertise at the event. Angel investor, business owner, and Joylux CFO Karen Howlett joined our forum sessions in Bellevue and Salt Lake City/Boise. In her keynote, she dives into the core components that make up Term Sheets and CAP Tables to help you, the investor, make informed decisions and better manage your deals.

CAP TABLES VALUATION

Karen emphasized that the most important considerations as an investor in CAP tables are the company valuation, stock price, and fully diluted stock. According to her, different people have different meanings for the concept of fully diluted stock. It is important to know whether it includes all stock options or only stock options that have been granted or exercised. She explained that it's good to thoroughly evaluate and understand what's on the CAP table.

Why do you need to know your fellow investors?

It's imperative to know who the company's investors are, how many of them are outside investors, and how much early-stage investment is from the founder's family and friends. Also, what are you investing in? Common stock, preferred stock, notes, equity, or stock option plans and evaluate these factors before investing.

Why does a Founder/CEO stock matter?

When it comes to a founder's stock, it's important to know how much he or she owns, which is enough to keep them committed to making the company successful. What is their motivation for staying? Have they invested? Are they getting a salary? Her advice is to understand their motives.

Another strong consideration she puts forth is - What happens to the founder’s equity if the founder leaves? If it is not subject to vesting or repurchase, it will have a substantial impact on the employee stock option. In addition, having to replace the founder can have a big impact on employees' stock options. Lastly, who owns the company IP? Is it the founder, the company or a university? These are a few questions an investor should get answered before investing.

Employee Stock Option Plan

When Karen first started investing, she didn't know much about employee stock options. When she started, she put 10% to 20% into the employee stock option plan. Over the next few years, as she spent more time investing, she realized that it was essential to know what stage the company was in, how much of the capital pool was allocated, how many new employees could be hired, and how many were in the pipeline, such as consultants and advisors. It's necessary to understand where you stand in terms of employee stock options, as adding them can significantly dilute your investment. Here’s an example of how investors lose share value from the employee stock option.

Example: The authorized shares of a company are worth $1 million, and as an investor, you own $250,000 worth of shares or 25% of the whole pool. If the company decides to increase the pool size by 20%, your percentage of ownership will drop below 21% of the company. With no new money coming in, you have no choice besides stock options.

A company has $1M Authorized Shares

Investor buys $250K = 25% shares

The company increases the employee stock option pool to 20%

Investor share value declines to less than 21%

The key learning here is that investors get diluted as there are additions in the pool.

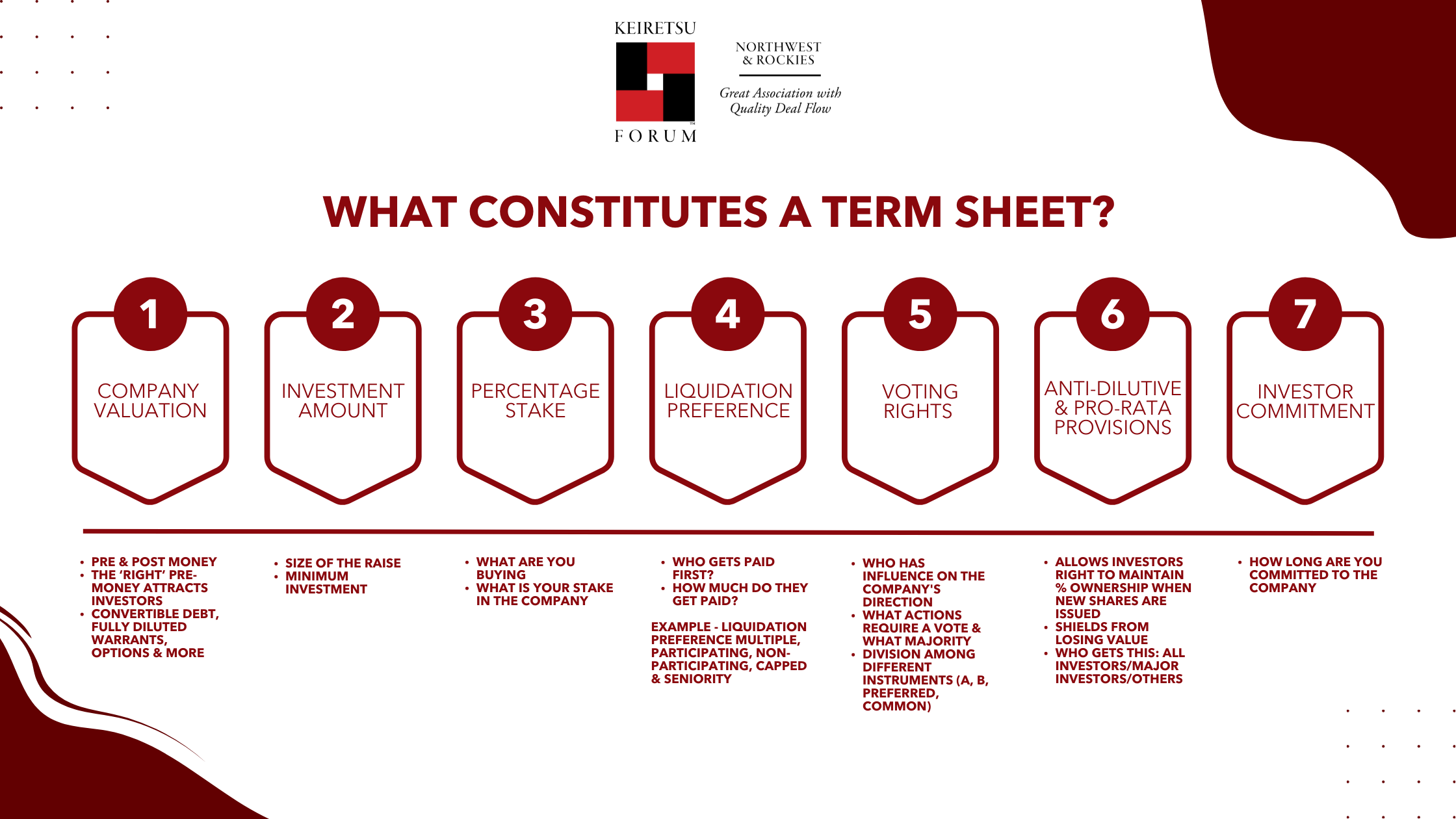

WHAT CONSTITUTES A TERM SHEET?

Karen stressed that all types of investments should have Term Sheets: equity, convertible, and SAFE notes. The Term Sheet is not a legal document and is non-binding, but it sets out the most basic terms of investment, so investors should pay attention to the content of the document.

SO WHAT’S A CONVERTIBLE NOTE?

Most convertible notes automatically convert when qualified financing is available. The financing must be higher than what they are raising now. Example: If you raise $2 million, ideally you need to convert the note to a higher amount. As an investor, you also need to know what price to convert at, the discount on the next equity round, or the discount off the next valuation cap. If the company is sold or there is a change of control, how does it affect conversion? What matters is that you have the opportunity to convert it yourself rather than getting paid off. Karen recalled that in some cases, companies were simply trying to pay off investors, rather than turning them into common stockholders, which could generate returns of up to three times as much. She believes the choice of conversion should not be a decision of the company, and you as an investor should not be forced to accept the majority in this situation, so always be aware of this fact when renewing convertible notes.

Is the maturity date of the convertible note, prepayable only with the consent of the note holder, or can companies choose to do so? Most people in the Northwest hate stocks and avoid SAFEs and convertible notes because traditional convertible notes have no valuation cap or maturity provisions. Other factors to consider include interest rates, length of the note, securities conversion, and the type of entity you wish to invest in. All of these are things to consider when reading your Term Sheet and making an investment.

TO-DOS

For the Investor:

- Like the company you are investing in

- Invest in the team

- Trust the entrepreneur

- Plan to invest in future rounds

For the Entrepreneur:

- Be coachable and be open to feedback

- Have a clear value proposition

- Have the right background & skills appropriate for this stage

- Products/solutions that are exciting/disruptive

- Sizeable market – is it worth the effort?

KEY TAKEAWAYS

According to Karen, the Term Sheet has a lot to offer, and don't miss a great opportunity when you're focused on the nitty-gritty of the documentation. She states that there was no perfect Term Sheet or prepared proposal document. One insight she offers is that entrepreneurs' responses to questions or feedback can be very revealing about how they run their business and how they feel about it. In their experience, they don't read documentation most of the time, but what matters is whether they have the expertise and are open to feedback. She continues to emphasize the importance of the Keiretsu Forum Term Sheet committee’s feedback on each deal. The Term Sheet committee consists of fellow experienced and accredited members that review each deal and provide their feedback in the Due Diligence report. If there is no feedback; you should request that feedback as it will give you the structure and guidance you need. Finally, if you don't understand something, ask questions and use the resources around you to maximize your knowledge.

ABOUT THE SPEAKER