Famous business institutions such as Harvard Business School, London Business School, Project Management Institute, and Boston Consulting Group have published and promoted several articles on the Strategy-Execution Gap in business. While strategy and execution are among the main levers of business transformation, is it really the gap between both that impedes success?

After reading through copious articles and studies about this mysterious gap, Kevin Fallon, Founder, President, and CEO of Pivotal Innovation, realized there is no gap between strategy and execution. There is just bad strategy and bad execution. Companies that focus on growing their value to customers enjoy over 2X performance growth compared to their peers that focus only on operations. Only by successfully implementing the growth levers can Value-Growth be achieved.

Business Transformation: The Growth Discipline Levers

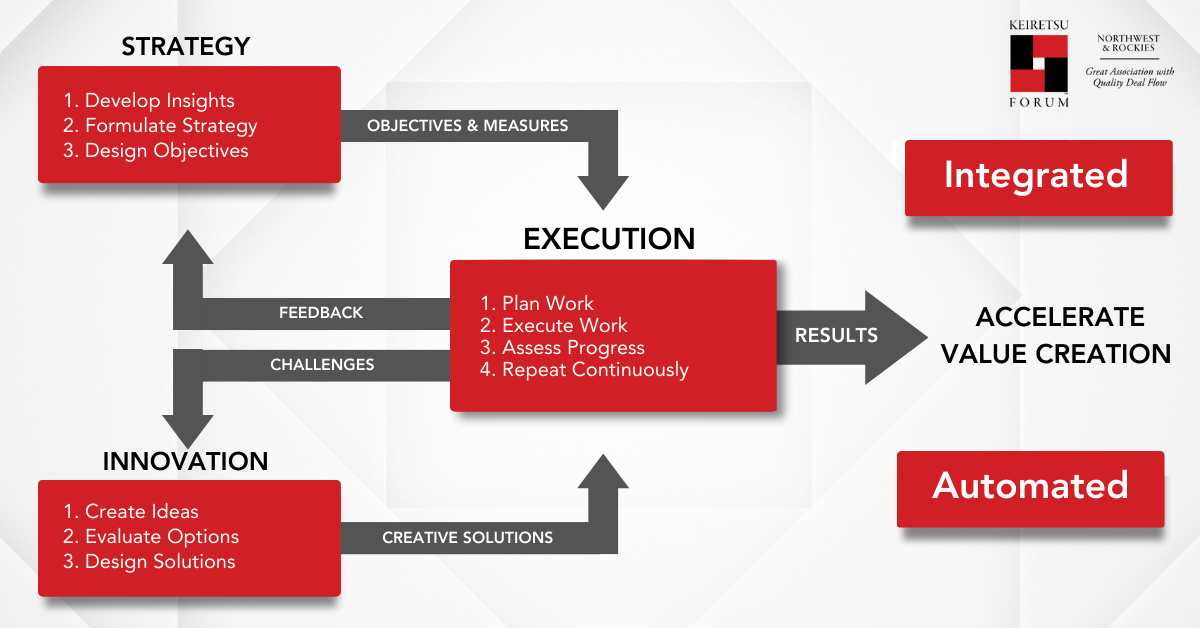

Every company has three growth levers - Strategy, Execution, and Innovation (SEI). When all three levers work in harmony, adding and deriving value from each other, businesses transform from their current operating state to their future operating-state driven by value acceleration. Assume you have a company in your portfolio that has developed a billion-dollar strategy. It still has two levers remaining - execution and innovation. Let us further break down each lever and understand its contribution to the SEI framework.

- Strategy: A Strategy is formulated after investing significant resources in research and deriving key insights from that research. It provides a roadmap for the business by setting clear goals and objectives, identifying target markets, understanding customer needs, analyzing competition, and making decisions on resource allocation.

- Execution: Execution is the implementation of the strategy through effective and efficient operational processes, systems, and actions. During the execution phase, it is important that feedback and challenges are generated. While feedback is provided for the strategy, challenges assert the need for innovation.

- Innovation: These are creative solutions that combat the challenges encountered during the execution of the strategy. It involves being creative, taking risks, and challenging the status quo to drive growth, competitive advantage, and sustainability.

Innovations trigger improvements in the strategy that requires execution that, in turn, generates more feedback and challenges, creating newer innovations to refine the Strategy further. And that's how the cyclic SEI framework continues to evolve. And with the completion of each cycle, value creation is accelerated.

The benefits of the SEI framework, are realized by integrating and aligning these three levers. An organization with a clear and well-defined strategy, effective execution capabilities, and a culture of innovation is better positioned to accelerate value creation.

Benefits of an Automated and Integrated Value Growth Engine - The Danaher Business System (DBS)

Now that we have understood the makings of an automated and integrated Value Growth Engine with the help of SEI, let us examine an actual business case study where this model has been developed and deployed for long-term success. The Danaher Business System (DBS) is a renowned operational and management philosophy used by Danaher Corporation, a global conglomerate with diverse business segments including healthcare, environmental and industrial, and product identification. With the implementation of DBS, Danaher managed to provide its shareholders with a market-crushing performance of 70,000% ROI between 1980-2015. So, what makes DBS so successful?

DBS is built on the principles of lean thinking, which originated from the Toyota Production System (TPS) and has been implemented across several industries. It emphasizes eliminating waste, standardizing processes, empowering employees, and relentlessly pursuing customer value.

- Strategy Alignment & Deployment: DBS starts with a clear and focused strategy that aligns with customer needs and business goals. Strategy Deployment involves setting strategic objectives, cascading them throughout the organization, and creating a visual management system to monitor progress. It ensures that every individual in the organization is aligned and working towards common objectives.

- Execution to Improve Processes & Performance: DBS emphasizes identifying and eliminating waste in processes to drive efficiency and effectiveness. It employs tools such as value stream mapping, root cause analysis, and mistake-proofing to identify areas of improvement and implement changes. DBS also promotes the use of standard work processes to establish consistency and stability. Daily Management involves establishing a regular cadence of reviewing key performance metrics, solving problems, and driving accountability at all levels of the organization. It includes activities such as tiered accountability meetings, visual management, and Gemba walks (going to the place where work is done) to identify and address issues in real-time.

- Innovation that Drives People Development and Enhances Strategy: DBS recognizes the importance of people in driving organizational success. It focuses on developing a culture of continuous learning, problem-solving, and empowerment. DBS provides tools and training to enable employees to contribute their best ideas, encourages teamwork and collaboration, and recognizes and rewards performance. This culture to promote innovation is what finally enhances the initial strategy through valuable feedback and improves business outcomes.

The impact of DBS can be seen in Danaher's impressive track record of sustained growth and operational excellence. Danaher has successfully applied DBS across its diverse portfolio of businesses, resulting in improved customer satisfaction, increased productivity, and enhanced shareholder value. DBS has also been recognized as a leading operational excellence methodology and has been adopted by many other organizations across various industries worldwide.

Strategy v/s Transformation: The Growth Acceleration Methodology

Transformational change in any organization is accelerated by the completion of strategic goals that focus on clear business objectives serving growth. To learn how strategic goals define transformation let us consider a business operating in its current state with no change in strategy. Now, the company hires three CEOs, each with a different strategy. While CEO 1 decides to employ a franchise model, CEO 2 decides the path to success is through implementing a ‘New Product Acceleration’ strategy. CEO 3 on the other hand believes a Merger and Acquisition strategy will make the business successful in the long run. Can you imagine how different this organization would appear under each CEO's strategy?

The transformation journeys would be vastly different depending on the strategic goals being pursued and that’s because strategic goals are always directional, and they always create a different set of transformational goals. Although strategic goals are led by the CEO it requires integration at all levels in the organization. As an investor, you can further break down the strategy of your portfolio company into a value-growth framework to map its transformational path. Here are a few key tools that drive the value-growth strategy framework.

- Thrusts: These are the highest-level strategic goals that set the direction for customer and company value creation.

- Objectives: Based on the strategic goals of the company, objectives are decided. These objectives are what transform or alter the process within the company to achieve the strategic goals.

- Initiatives: Once clear objectives have been laid out different teams can then take up projects or initiatives to alleviate constraints and advance the objectives of the company

- Tasks: The final cog in the transformational wheel is the daily, weekly, and monthly tasks that action the initiatives through work deliverables and achieving new milestones

- Measurement: Akin to the goals set by your portfolio company, the success of those goals is also measured independently based on the nature of those goals. Financial measures include the Key Performance Indicators (KPIs) that are directly proportional to the flow of value to customers. Similarly, for any goal that involves an element of financial risk, you can adopt the ROI model of measurement.

Importance of a Customer-Focused Methodology

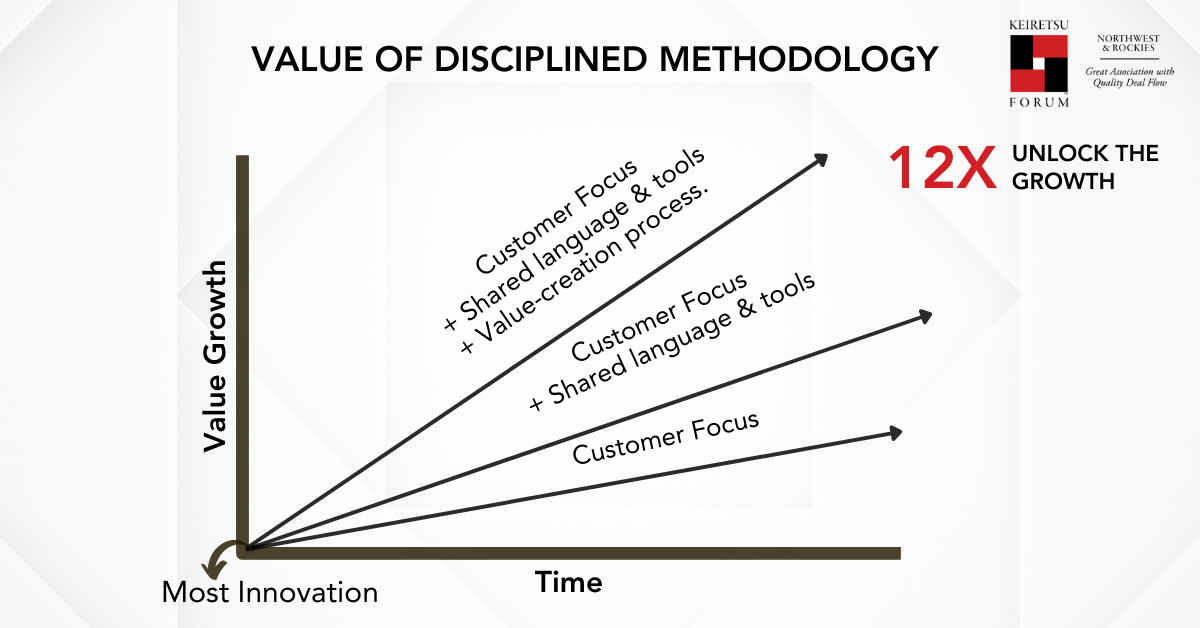

According to Curt Carlson, former President and CEO of SRI International, less than 30% of new initiatives in tech companies add any measurable value to the enterprise. In addition to 70% of the new initiatives being a waste, less than 10% of companies had a thoughtful innovation process. The differentiator between the successful and unsuccessful initiatives was the customer focus approach at the center. Customer-Centricity armed with a shared language and well-defined value-creation process is what separates the top 10% from the rest. The Product Development Management Association (PDMA) conducted a study wherein the companies in the top quarter and bottom quarter of each industry were examined. The ROI on every dollar spent for innovation between the companies in both quarters was an astounding 12X.

How to be a Value-Adding Investor?

When evaluating the goals of your portfolio company you need to realize that strategic goals only imagine a better future state for the company but they don’t deliver it. For your company to reach its desired future state it will require the precise execution of high-quality value-creation initiatives. As an investor, you need to be a part of these initiatives that flow value to customers. Every conversation that you engage in with your portfolio company leaders needs to focus on transformational changes that accelerate the value growth engine.

About the Speaker: Kevin Fallon is the founder and CEO of Pivotal Innovation, a company dedicated to empowering companies to accelerate strategy deployment and innovation performance. He has over 30 years of business experience beginning with RCA Space and General Electric, and subsequently as a founder of five technology ventures and as President/COO with two publicly traded corporations.